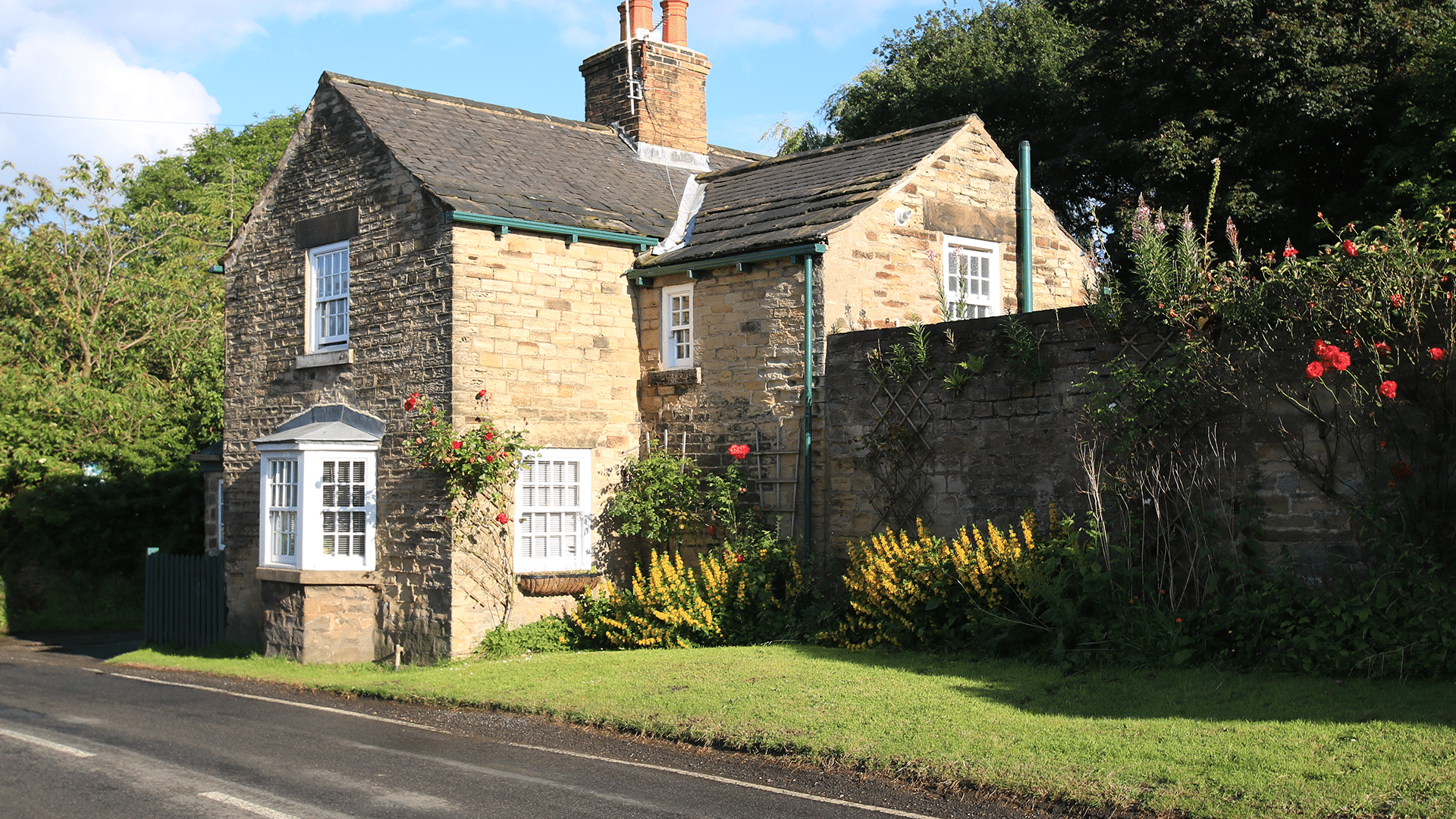

Second Charge Mortgage Advice in Cardiff

Depending on the situation you happen to be in, a second mortgage may be a possible option for you to look at utilising. There are two different methods this can be achieved.

You may be able to obtain a Second Mortgage for buying an additional home or taking out a Buy to Let, allowing this to run alongside your existing mortgage. Alternatively, you may have the option of a Second Charge, where you take out an additional mortgage amount against the same property, with a different mortgage lender.

Below we’ve put together a guide on where this could be applicable, as well as a helpful video guide where Malcolm talks about the significance of taking out a second mortgage in Cardiff.

Why would you take out a second mortgage in Cardiff?

There are various different situations where someone might find themselves needing to have more than one mortgage. Through our experience as mortgage advisors in Cardiff we’ve heard of some fairly common recurrences, with these including, but not limited to;

1) Wanting a second mortgage to raise money for your existing home.

2) Looking to rent out your existing home and purchase a new one.

3) In the market to buy a new property with your name on another mortgage already.

4) Looking to help your children out with a second mortgage.

5) In need of a second mortgage to purchase a buy to let property.

Looking at the latter one, we feel it’s important to let you know that we have a vast wealth of knowledge on Buy to Let mortgages in Cardiff, having worked with many lenders including very specialist ones, all with their own unique lending criteria.

We also have a long history of helping Buy to Let Landlords with their properties. For more information on being a Landlord, please check out our Buy to Let Mortgage Advice in Cardiff page.

Second Mortgage to Raise Money

If you have equity in your home, you could have the option to take out a Second Charge to release this equity and fund the deposit for a potential additional purchase. It can also be just generally used for any purchase, such as a new car, a holiday or something else.

The way a Second Charge works is that if you still have equity sitting in your property, you may be able to take out a mortgage with a second lender, in order to release some of the equity in the property.

Usually, if you are on a lenders Standard Variable Rate, we are able to shop around for you and find a more competitive deal whilst also releasing Capital. A further advance with your existing lender may also be an option available to you.

Second Mortgage to Rent out Existing Home to Purchase a New One

In some cases, homeowners may be looking to keep hold of their existing property, with the intention of renting it out a taking out a second residential mortgage on a new property. This process is known as a Let-to-Buy Mortgage and has become increasingly popular over the last decade.

Second Mortgage to Purchase a Home For Your Children

Sometimes your Children or even Grandchildren may be struggling to find their footing on the property ladder. As such we regularly see homeowners using either a Second Charge to release some equity to gift their loved one either a portion of, or the full amount of deposit.

Second mortgage for a Buy to Let in Cardiff

We find that there are many landlords looking to purchase additional Buy to Let properties to add to their portfolio, by taking out a second mortgage. Our team are able to use our expert knowledge to recommend the most suitable Buy to Let mortgage product based on your personal circumstances. You will be asked to produce a higher deposit for this mortgage than a typical residential mortgage.

Named On an Existing Mortgage and Want to Buy a New Home

If you are currently named on another mortgage and unable to get your name taken off of it, you may still want to try your luck and apply for a mortgage of your own. This is a situation we come across often and have experience helping many different customers with.

Specialist Mortgage Advisor in Cardiff

No matter your situation, if you are looking to get a second mortgage, we may be able to help. As a fast & friendly mortgage broker in Cardiff, our Advisors are able to search thousands of mortgage deals on your behalf, following up with a recommendation on the most suitable product for you based on your personal situation.

For more information get in touch to book your free initial mortgage consultation, and speak with a dedicated mortgage advisor in Cardiff.

Date Last Edited: October 9, 2024